San Francisco Real Estate Spring 2020 Report

Supply and demand statistics, median sales price trends, sales and values by city district, the luxury home market, and the ongoing effects of COVID-19.

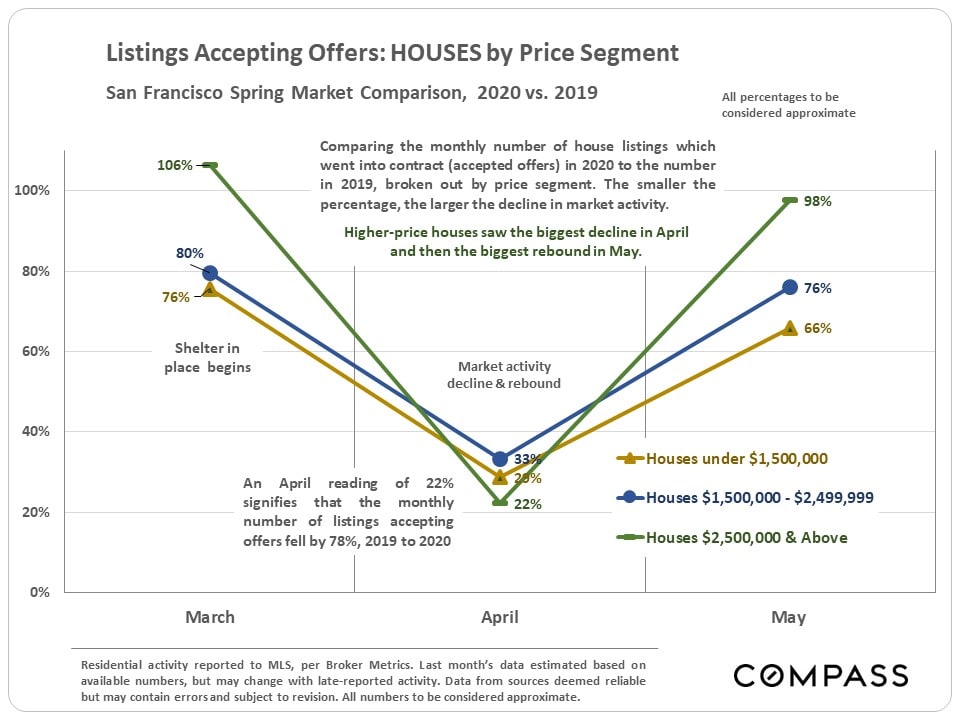

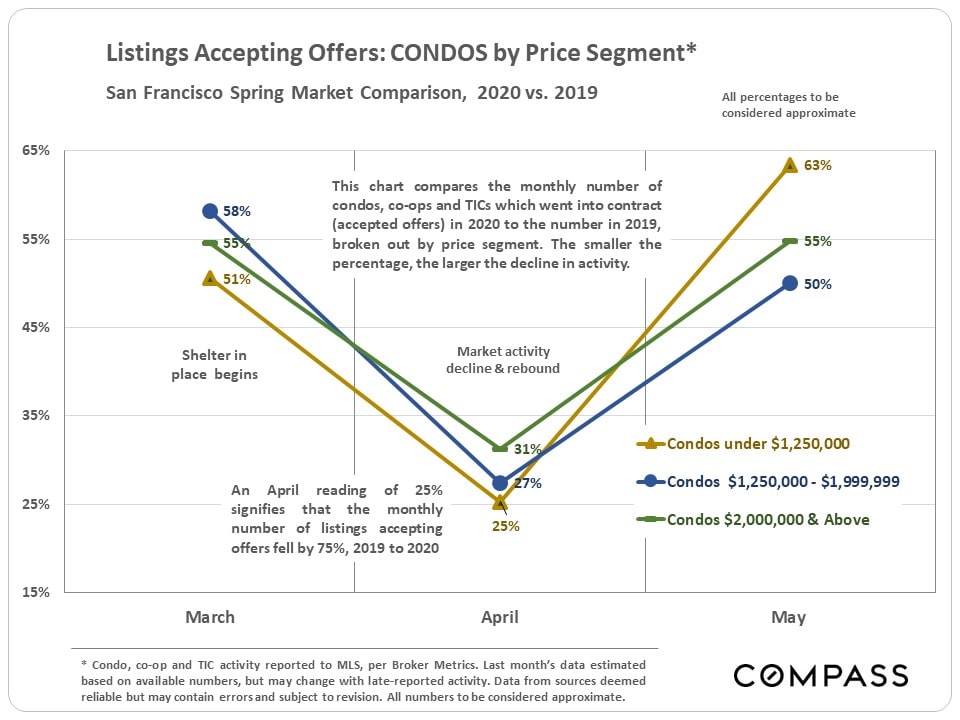

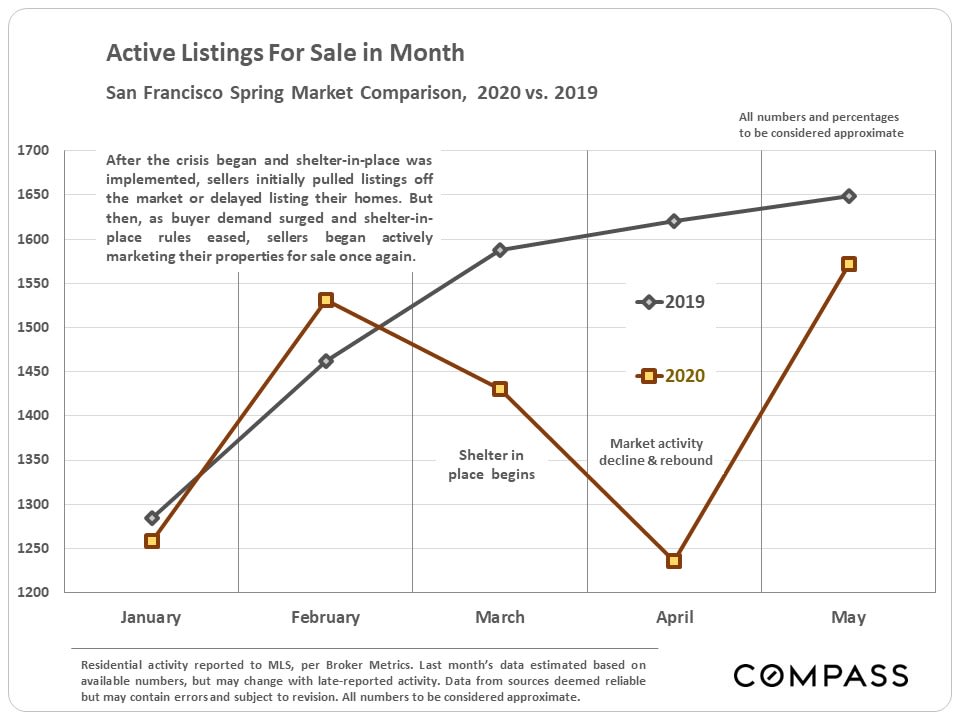

Generally speaking, market activity – as measured by the number of listings going into contract – continued to pick up rapidly in May, bouncing back from the steep plunge following the first shelter in place orders. However, activity in May, which is typically among the busiest selling months of the year, still remained well below May 2019. Still, with the easing of shelter in place, as well as the market learning to adjust to new circumstances, it is expected the recovery will continue to surge closer to normal.

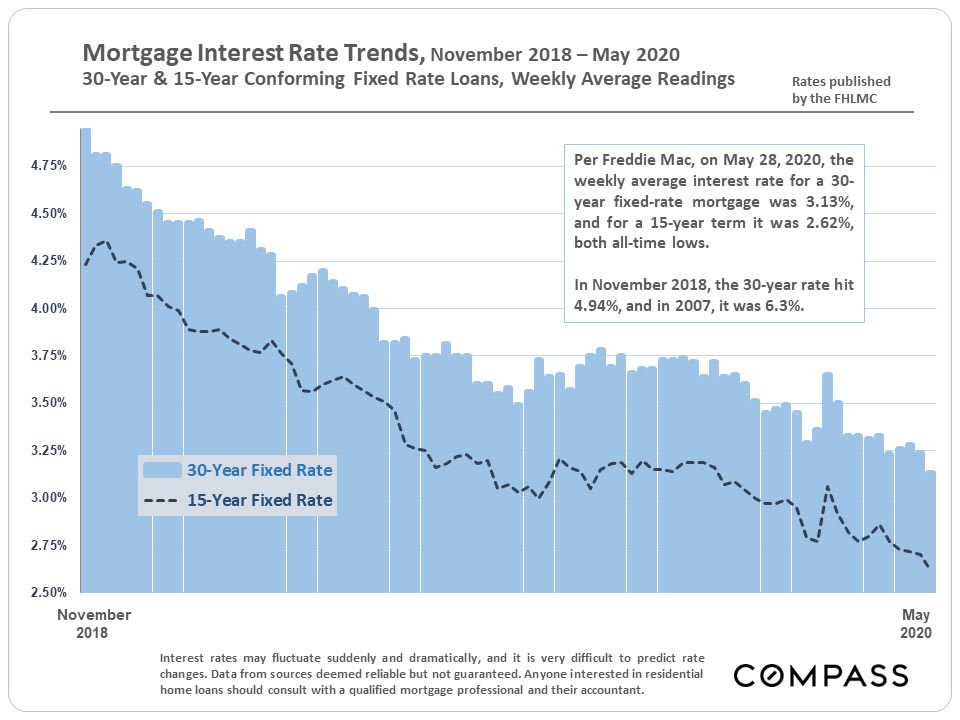

Interest rates hit yet another historic low at the end of May.

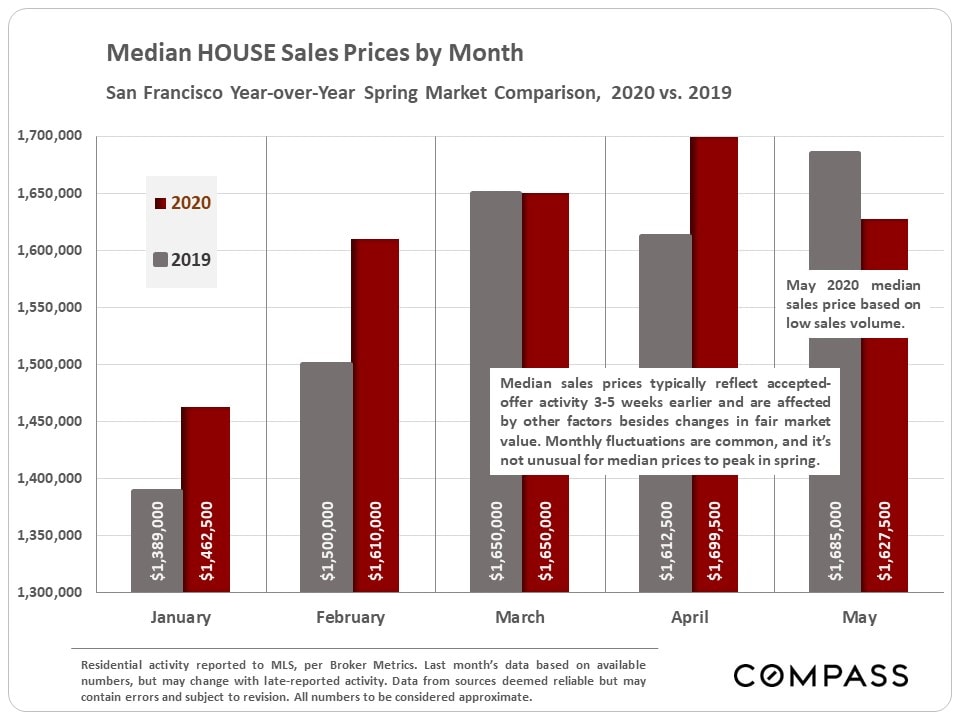

Median sales prices for both houses and condos dropped significantly in San Francisco in May, but those figures are based on a very low volume of closed sales in the month. An even bigger drop in higher-price home sales also put downward pressure on median prices. May sales and sales prices mostly reflect the huge impact of COVID-19 on the San Francisco market in late March and April. Based on the large jump in accepted-offer activity in May (and especially for more expensive homes), coming months will constitute a better indicator of whether changes in fair market value are occurring.

Anecdotally, word on the street is that buyer demand has come surging back and home prices have so far been little affected, though opinions vary regarding different market segments. We'll know more soon.

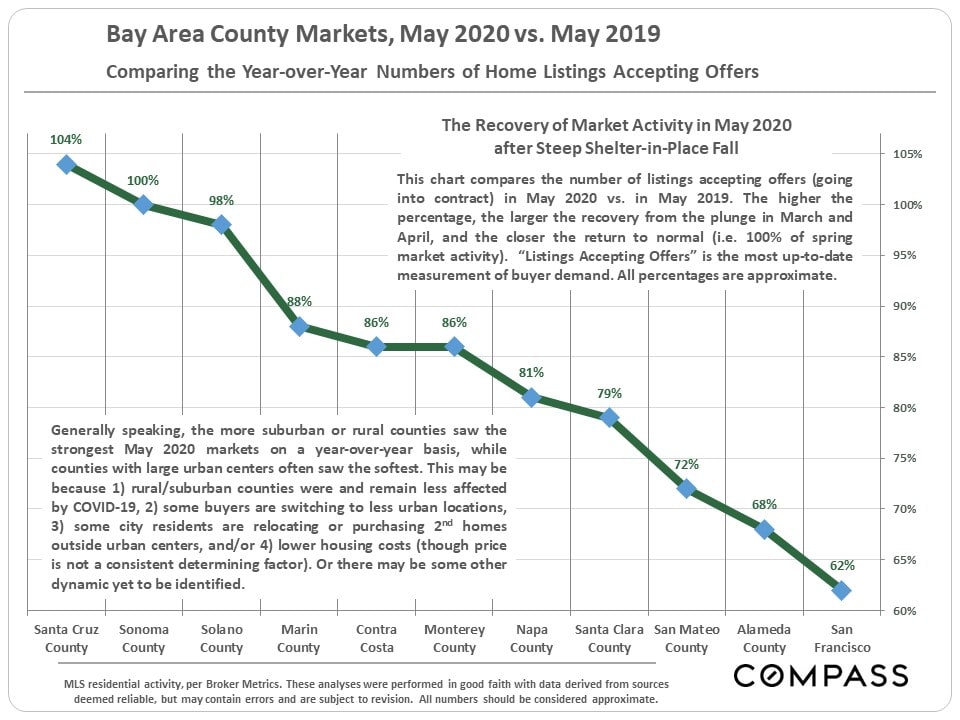

The San Francisco market – as also common in other urban centers – was more deeply and more quickly affected by COVID-19 and shelter-in-place than other more suburban county markets, seeing larger initial drops in activity. Even with the remarkable rebound of buyer demand in May, its recovery is, so far, lagging other counties on a year-over-year basis, especially more suburban and rural counties, such as Marin and Sonoma. A variety of factors may be at play, however definitive pronouncements regarding longer-term market, economic and demographic effects are impossible to make while the crisis is still at hand.

NOTE: Any statistics derived from closed sales – such as median sales prices, sales volume and days on market – reflect the state of the market 3-6 weeks ago when the offers were negotiated and accepted – and when the market was most terribly impacted by the crisis.

NEW Listing I 2865 Green Street

3 Beds | 2.5 Baths | 2 plus Parking

Listed at $4,750,000